Challenger Banks Don’t Stand Out Anymore but Can Designers Save Them?

The fintech space is becoming homogenised so designers will need to work with AI to create services that are distinct, useful and intuitive argues ANNA co-founder and Chief Design Officer, Daljit Singh.

A lot of challenger brands in banking – and maybe fintech in general – are starting to look, feel and function in the same way; design seems to be coasting along on a comfortable, even plateau. Products are mostly robust and usable, following the same UX design tropes to enable customers to uneventfully get from A to B.

And yet there’s the persistent sense that it’s all just good enough; none of it is great; none of it is revolutionary; none of it is trying to anticipate new problems and solve them in imaginative ways. I suspect most are quite happy on that plateau, particularly if it’s comfortable and not causing them any problems.

If we go back 25 years, digital design and technology were rife with boundary-pushing experimentation. The 1990s and early 2000s were a golden age of interactive design, and while some of the work that came out of this period may look dated in retrospect, it drove innovation and visual expression to entirely new places.

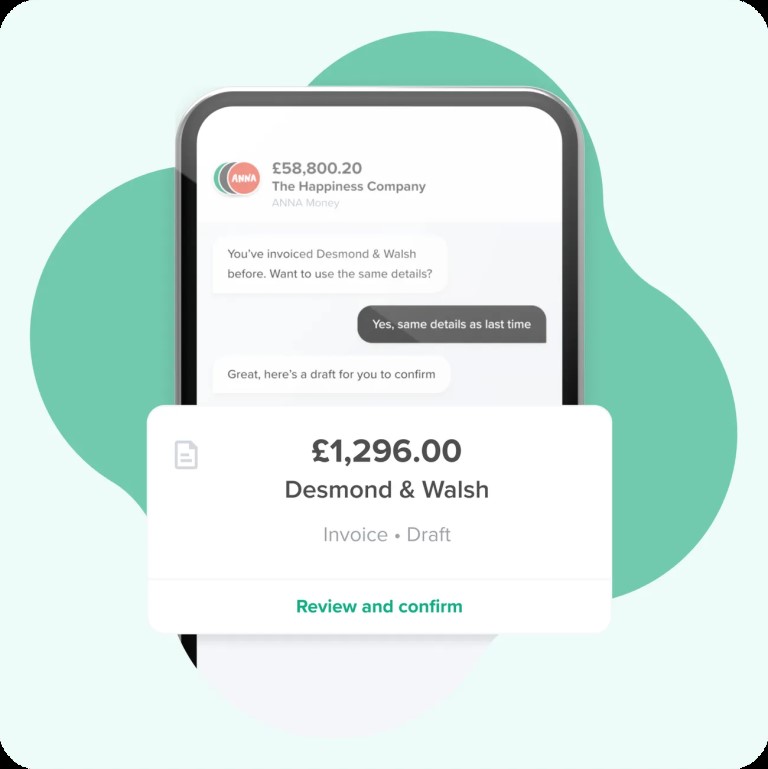

ANNA’s chat function features across the app

Six years ago, and some 27 years after I started in interactive design, I entered the fintech world by helping to found ANNA, which provides business accounts to small businesses and sole traders. Very early in ANNA’s journey, we decided that it wouldn’t look, feel or function like other financial apps. It would be chat-based. Yes, there would be menus where you could access account information or statements, but the main interaction would be conversation. Want to create an invoice? Just ask. Want to set up a direct debit? Just ask.

AI virtual assistants should be imperceptible

Banking and fintech are going to change massively in a very short period of time: AI is going to absolutely transform the industry and the relationship between organisations and customers. We are going to see personalised user experiences with tailored product recommendations, customised dashboards, and bespoke financial insights. There will be AI-powered chatbots and virtual assistants that can provide 24/7 customer support. In short, banking apps will feel a lot more like smart financial assistants. And a lot of brands are going to be playing catch-up.

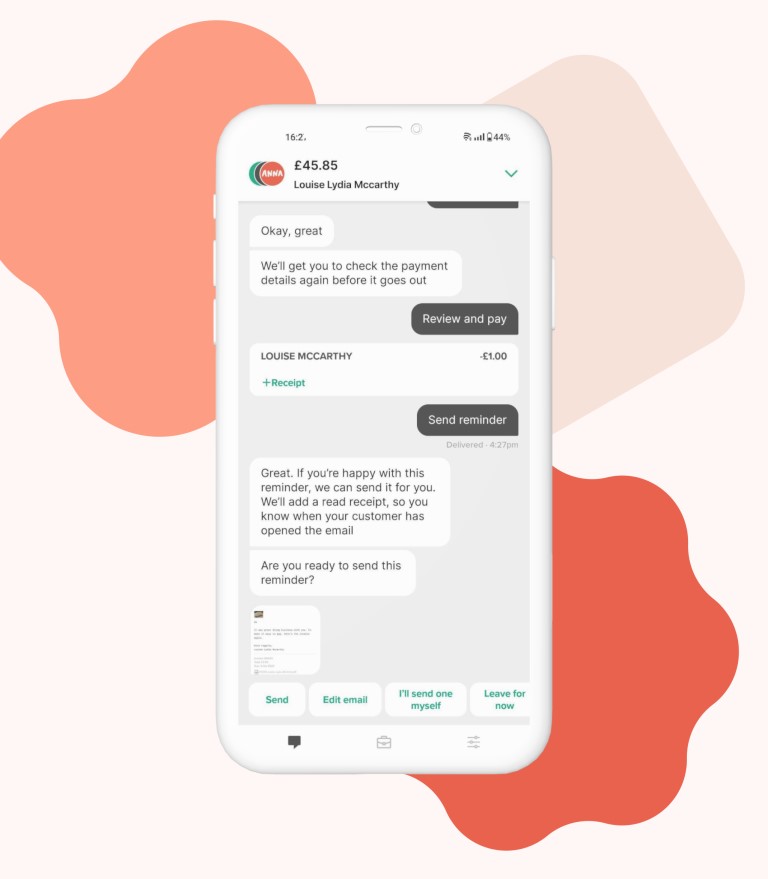

AI-enabled chat has been embedded into ANNA from its beginnings

ANNA was created with AI at its heart. We started developing our own Language Model in our first year, before AI was a buzzword and every brand was trying to bolt ChatGPT onto their services. AI is embedded into ANNA so that it’s intuitive and barely perceptible. Our starting point was: “How can we make the best app for our customers?” not “How can we make an app that looks like every other app out there?”

At ANNA we’re on a mission to eradicate customer frustration, while adding moments of joy and personality. We want to provide sleek, imperceptible services – and that needs a band of diverse designers and broad thinkers to innovate them.

The erasure of personal admin

New ideas, approaches and thinking processes will displace old, accepted thinking to push technology to become useful and utilitarian. It’s not about the algorithm approving or rejecting a loan application – it’s about money management happening for you, about vital transactions taking place for you before it escalates or unsubscribing from services you don’t use. AIs will streamline admin for us and become the assistants we dreamt about, enabling busy people to engage with their finances in a swifter, neater way. We want people to look up and build their businesses not down to do their admin.

AI can’t do it all – good designers are needed

Artificial Intelligence is making big promises and its impact when combined with quantum computing will improve many customer-facing services beyond recognition. But there’s also a danger that sectors such as fintech will come to rely too much on AI to do all the heavy lifting. If banks want to have better relationships with their customers, they’ll need to invest in human input via good design. To build true intelligence the banking sector needs more designers; people who understand that the future is there to be shaped, and that for all the value of AI, it’s the experience of the brand and product that matters most, that’s where you really nurture customer relationships.

Written by: Daljit Singh

Article source: designweek.co.uk